Leather Industry : Striding & Confidence

Leather Industry – Overview, Export Performance and Prospects

The Leather Industry holds a prominent place in the Indian economy. This sector is known for its consistency in high export earnings and it is among the top ten foreign exchange earners for the country.

With an annual turnover of over US$ 12 billion, the export of leather and leather products increased manifold over the past decades and touched US$ 6.5 billion during 2014-15, recording a cumulative annual growth rate of about 13.10% (5 years).

The Leather industry is bestowed with an affluence of raw materials as India is endowed with 21% of world cattle & buffalo and 11% of world goat & sheep population. Added to this are the strengths of skilled manpower, innovative technology, increasing industry compliance to international environmental standards, and the dedicated support of the allied industries.

The leather industry is an employment intensive sector, providing job to about 2.5 million people, mostly from the weaker sections of the society. Women employment is predominant in leather products sector with about 30% share.

India is the second largest producer of footwear and leather garments in the world.

The major production centers for leather and leather products in India are located in:

- Tamil Nadu – Chennai, Ambur, Ranipet, Vaniyambadi, Vellore, Pernambut, Trichy, Dindigul and Erode

- West Bengal – Kolkata

- Uttar Pradesh – Kanpur, Agra, Noida, Saharanpur

- Maharashtra – Mumbai

- Punjab – Jallandhar

- Karnataka – Bangalore

- Andhra Pradesh – Hyderabad

- Haryana – Ambala, Gurgaon, Panchkula, Karnal and Faridabad

- Delhi Madhya Pradesh – Dewas

- Kerala – Calicut and Ernakulam / Cochin.

Strengths of Indian leather sector

- Own raw material source – 2 billion sq ft of leather produced annually

- Some varieties of goat / calf / sheep skins command premium position

- Strong and eco-sustainable tanning base

- Modernized manufacturing units

- Trained / skilled manpower at competitive wage levels

- World-class institutional support for Design & Product Development, HRD and R & D.

- Presence of support industries like leather chemicals and finishing auxiliaries

- Presence in major markets – Long Europe experience

- Strategic location in the Asian landmass

Emerging strengths

- Design development initiatives by institutions and individuals

- Continuous modernization and technology upgradation

- Economic size of manufacturing units

- Constant human resource development programme to enhance productivity

- Increasing use of quality components

- Shorter prototype development time

- Delivery compliance

- Growing domestic market for footwear and leather articles

Highlights of Leather Product Segments

Tanning Sector

Annual production 2 billion Sq.ft. Accounts for 10% of world leather requirement. Indian colors continuously being selected at the MODEUROPE Congress.

Footwear Sector

Second largest footwear producer after China. Annual Production 2065 million pairs. Huge domestic retail market 1950 million pairs (95%) are sold in domestic market. Footwear export accounts for 45% share in India’s total leather & leather products export. The Footwear product mix Gents 55%, Ladies 35% and Children 10%.

Leather Garments Sector

Second largest producer with annual production capacity of 16 million pieces. Third largest global exporter. Accounts for 9% share of India’s total leather export.

Leather Goods & Accessories Sector including Saddlery & Harness

Fifth largest global exporter. Annual production capacity – 63 million pieces of leather articles, 52 million pairs of Industrial gloves & 12.50 million pieces of Harness & Saddlery items. Accounts for 25% share of India’s total export.

Product-wise Brands sourced from India:

| Footwear | Leather Garments | Leather Goods / Accessories |

|---|---|---|

| Acme, Ann Taylor, Bally, Charter Club, Clarks, Coach, Colehann, Daniel Hector, Deichmann, DKNY, Double H, Ecco, Elefanten, Etienneaigner, Florsheim, Gabor, Geoffrey Beene, Guess, Harrods, Hasley, Hush Puppies, Kenneth Cole, Liz Claiborne, Marks & Spencer, Nautica, Next, Nike, Cole Haan, Nunn Bush, Pierre Cardin, Reebok, Rockport, Salamander, Stacy Adams, Tommy Hilfiger, Tony Lama, Versace, Yves St. Laurent, Zara, Johnston & Murphy, Docksteps, Timberland, Armani, Geox, Diesel, Ted Baker, Lacoste, Kickers, Calvin Klein, Sioux, Brasher, Zegna, Massimu Dutti, Buggatti, Lloyd, Christian Dier, Salamander, Camper, Bata, Espirit, French Connection, Legero, Mercedez, H & M and many more famous brands | Armani, Zegna, Abercrombie & Fitch, Marco Polo, Mango, Colehaan, Andre Maarc, Guess Pierre Cardin, Tommy Hilfiger, Versace, DKNY, Liz Claiborne, Ann Taylor, Nautica, Kenneth Cole, Charter Club, Daniel Hector | Coach, Liz Claiborne, Harrods, Yves St, Laurent, Tommy Hilfiger, Etienne Aigner, Geoffrey Beene, Marks & Spencer, Guess, Next, Pierre Cardin, Prada, GAP, Levis, H & M, British Home Stores, Banana Republic, Furla, American Eagle Outfitters, Bracciliani, Walmart etc. |

Besides, major brands are sourced from India, MNC brands are sold in India and Indian brands sold in India.

| MNC Brands Sold in India | Indian Brands sold in India |

|---|---|

| Aldo, Bally, Clarks, Ecco, Florshiem, Ferragammo, Hush Puppies, Lee cooper, Lloyd, Marks & Spencer, Nike, Nine West, New Balance, Reebok, Rockport, Stacy Adams, Tod’s, Geox , Louis Vuitton | Red Tape, Bata, Liberty, Khadims, Lakhani, Metro, Action |

India’s Export of Leather and Leather products for Five years

(Value in Million $)

| 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | |

|---|---|---|---|---|---|

| Finished Leather | 841.13 | 1024.69 | 1093.73 | 1284.57 | 1329.05 |

| Footwear | 1758.67 | 2079.14 | 2066.91 | 2557.66 | 2945.15 |

| Leather Garments | 425.04 | 572.45 | 563.54 | 596.15 | 604.25 |

| Leather Goods | 855.78 | 1089.71 | 1180.82 | 1353.91 | 1453.26 |

| Saddlery & Harness | 87.92 | 107.54 | 110.41 | 145.54 | 162.70 |

| Total | 3968.54 | 4873.53 | 5015.41 | 5937.97 | 6494.41 |

| % Growth | 22.80% | 2.91% | 18.39% | 9.37% |

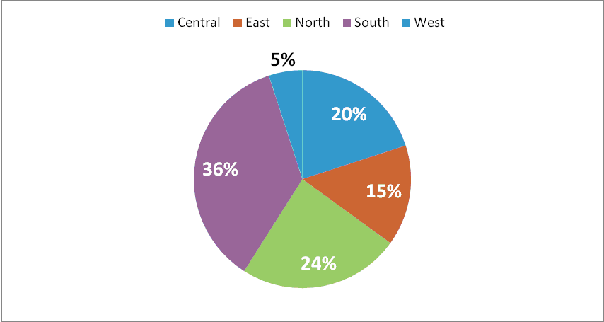

Major Markets

The major markets for Indian Leather & Leather Products are Germany with a share of 12.32%, USA 11.83%, U.K. 11.57%, Italy 7.76%, France 5.72%, Hong Kong 6.50%, Spain 5.41%, Netherlands 3.46%, China 2.99%, Denmark 1.29%, UAE 4.3%, Belgium 1.68%,

These 12 countries together accounts for nearly 75% of India’s total leather& leather products export.

European Union accounts for 56% of India’s total export of leather and leather products.

India’s Export of leather & leather products to different countries – 5 years

(Value in million USD)

| COUNTRY | 2010-11 | 2011-12 | 2012-13 | 2013-14 | 2014-15 | % Share 2014-15 |

|---|---|---|---|---|---|---|

| Germany | 575.38 | 731 | 631.23 | 765.56 | 800.2 | 12.32% |

| Italy | 455.76 | 528.35 | 438.53 | 518.04 | 504.26 | 7.76% |

| UK | 505.2 | 543 | 606.02 | 664.92 | 751.33 | 11.57% |

| USA | 348.13 | 439.54 | 526.13 | 680.22 | 768.06 | 11.83% |

| Hong Kong | 325.2 | 359.47 | 441.45 | 471.56 | 422.11 | 6.50% |

| Spain | 247.99 | 296.06 | 267.17 | 308.07 | 351.27 | 5.41% |

| France | 280.04 | 303.84 | 320.81 | 354.72 | 371.75 | 5.72% |

| Netherlands | 155.43 | 198.7 | 189.74 | 218.55 | 224.92 | 3.46% |

| U.A.E. | 74.27 | 109.28 | 126.52 | 180.54 | 281.07 | 4.30% |

| Portugal | 39.62 | 46.55 | 38.35 | 51.84 | 68.39 | 1.05% |

| Belgium | 80.89 | 113.06 | 92.97 | 95.73 | 108.88 | 1.68% |

| China | 75.48 | 124.75 | 124.36 | 153.57 | 194.26 | 2.99% |

| Australia | 51.81 | 67.84 | 74.16 | 78.31 | 84.66 | 1.30% |

| Denmark | 57.75 | 74.18 | 89.65 | 89.37 | 83.9 | 1.29% |

| Sweden | 31.36 | 44.33 | 45.91 | 50.61 | 46.48 | 0.72% |

| Canada | 29.32 | 40.02 | 45.71 | 51.43 | 59.24 | 0.91% |

| Korea Rep. | 29.04 | 31.31 | 38.21 | 46.77 | 58.17 | 0.98% |

| South Africa | 32.14 | 41.18 | 36.07 | 48.16 | 55.04 | 0.85% |

| Switzerland | 25.02 | 33.54 | 30.3 | 32.82 | 37.05 | 0.57% |

| Austria | 27.01 | 38.43 | 36.46 | 40.06 | 35.48 | 0.55% |

| Greece | 10.05 | 10.96 | 8.41 | 12.01 | 14.22 | 0.22% |

| Saudi Arabia | 22.14 | 41.68 | 42.37 | 38.67 | 47.42 | 0.73% |

| Japan | 21.74 | 33.04 | 38.7 | 48.73 | 56.21 | 0.87% |

| Russia | 19.99 | 33.04 | 28.54 | 51.57 | 49.96 | 0.77% |

| Indonesia | 20.15 | 25.24 | 26.82 | 27.17 | 28.95 | 0.45% |

| New Zealand | 5.98 | 7.29 | 7.23 | 9.66 | 12.11 | 0.19% |

| Others | 399.45 | 521.14 | 572.69 | 725.25 | 968.72 | 15.75% |

| Total | 3968.54 | 4873.53 | 5015.41 | 5937.97 | 6494.41 | 100.00% |

Future Outlook:

The Government of India had identified the Leather Sector as a Focus Sector in the Indian Foreign Trade Policy in view of its immense potential for export growth prospects and employment generation. Accordingly, the Government is also implementing various Special Focus Initiatives under the Foreign Trade Policy for the growth of leather sector. With the implementation of various industrial developmental programmes as well as export promotional activities; and keeping in view the past performance, and industry’s inherent strengths of skilled manpower, innovative technology, increasing industry compliance to international environmental standards, and dedicated support of the allied industries, the Indian leather industry aims to augment the production, thereby enhance export, and resultantly create additional employment opportunities.